Best pet insurance: Essential cover to put your mind at ease

Covering your pet with the best pet insurance will give you peace of mind in case of emergency

Researching the best pet insurance to cover your furkid in event of an emergency is an essential consideration for any pet owner. Vet bills can break the bank if you don't have any cover in place, it is impossible to know when or if your beloved furbaby is going to eat something they shouldn't, or even fall ill with something serious.

In many places it is illegal to own a dog without any insurance, but extending it in order to cover health issues can be a life saver, particularly when your barking buddy is ageing. Treatment for arthritis or joint issues, common ailments in older pooches, could set you back over $3000. It's not just dog owners who should consider insuring their pet either, cats who venture outdoors can regularly get into fight, without a word of warning. Bites and scratches from other Toms and strays get infected easily, and treating these wounds can cost you as much as $2,500. So, it just makes sense that you should do as much research into insurance as you would for the best dog food or best cat toys in order to keep your pet happy and healthy, and leading a long life.

Take a look at how to choose the best pet insurance and what should look out for when shopping for the best policy to ensure you get the best cover for you and your pet, plus learn more about how pet insurance works with our handy guide.

If you aren't sold on traditional insurance plans, you might also want to consider a prescriptive pet insurance plan or a pet savings account and learn if these will suit you and your lifestyle better.

Whatever you go for, make sure you take note of any fine print. The general rule when it comes to insurance is that many longterm conditions and certain treatments won't be covered, for example spaying and some vaccinations.

Altering the excess can affect monthly premiums too, so keep this in mind. Start your research with our list below and follow up with a price comparison website such as GoCompare in the UK and Pet Insurance Review in the US and Canada to help you get the best deal.

PetsRadar's pick of the best pet insurance

Why you can trust PetsRadar

Pets Best

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

When it comes to flexible coverage, low premiums, and a simple claims process, Pets Best are pretty darn hard to beat. Founded in 2005 by veterinarian Dr. Jack Stephens, the company has gone from strength to strength over the years and now ensures over 100,000 pets across the country.

Pets Best offers three types of plans: accident-only, accident and illness, and wellness benefits. Their accident-only policy is their lowest cost plan and is designed to protect your pet if something unexpected happens (such as eating something they shouldn't) but it doesn't cover illnesses. There's an annual limit of $10,000.

Their accident and illness plans come in three different policies - Essential, Plus, and Elite. The Essential plan covers things like procedures, lab tests, and medications while the Plus plan includes exam fees. The Elite plan also includes chiropractic care and acupuncture. All three have annual limit options of $5,000 or unlimited.

You can supplement the accident and illness plans with an Essential Wellness or Best Wellness add on policy which include things like microchipping, vaccinations, and dental treatment.

An accident-only policy starts at $9/month for dogs and $6/month for cats while the Wellness plans can cost up to $26/month for both dogs and cats. There's a three day waiting period for accident-only policies and 14 days for illness coverage and unfortunately, pre-existing conditions aren't covered. End-of-life expenses, such as cremations, are also excluded from the policies offered by Pets Best.

Those small drawbacks aside, Pets Best is an outstanding insurance provider, particularly when it comes to claims, leading the way with the first fully digital filing experience via their website or app. You can also access their 24/7 helpline where veterinary experts are on hand to offer advice and support.

Progressive

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

If you're looking for a minimum-coverage policy, then Progressive is well worth checking out. While it won't give you as much depth as some other insurance policies will, Progressive does a great job of keeping premiums affordable.

Progressive seems limited to cats and dogs – the detail on the website is sparse, and only cats and dogs are included as options. There are two types of plans: Accident Only, which covers accidental injuries; and BestBenefit, which covers illnesses and injuries. These are accompanied by two optional add-ons: BestWellness and Essential Wellness, which pay for routine care like vaccinations and checkups.

While the policies can be very cheap – in some cases starting from as low as a few dollars a day – end-of-life expenses like burial and cremation aren't covered, and there is no option taking into account pre-existing conditions. Still, the premiums are very affordable, and overall this is a handy option at the budget end of the best pet insurance range.

Prudent Pet

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

For the multi-pet household, Prudent Pet offers an excellent 10% discount that makes them our pick of the bunch. They also don't have a maximum age limit and their benefits can be used at vets throughout the US and Canada, offering great flexibility.

They offer two core basic plans - one that's accident only and one that covers accident and illness. Both allow you to fine tune the coverage by choosing the annual limit, the deductible, and the reimbursement amount. You can also get add-ons that cover things like vaccinations, medical boarding, and cremation/burial.

Because of the comprehensive benefits Prudent Pet offers, their monthly prices are steeper than some companies with older cats and dogs costing significantly more than younger pets. An accident-only policy starts from $15/month for dogs and $11/month for cats with accident and illness cover starting at $26/month for dogs and $15/month for cats.

Prudent Pets doesn't offer coverage for pre-existing medical conditions before the policy has begun but they will waive that for most conditions provided no treatment is needed for at least 180 consecutive days. Non-emergency dental procedures aren't covered, however you can purchase an add-on for this.

While Prudent Pets might be a relatively new company (they launched in 2018) they continue to hold the number one spot on Trustpilot with an impressive rating of 4.7 out of 5, so if you have more than one pet, this reputable company is well worth a try.

Trupanion

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

Trupanion might not have the range of choice that some of its competitors offer, but that doesn't matter because there's plenty of other huge draws when it comes to this company.

Offering just one single base plan that covers cats and dogs, there's nothing customizable here except for the annual deductible. That being said, if you want additional coverage, you can choose one of two policy enhancements - The Recovery or Complimentary Care rider which can cover you for non-clinical treatments, such as physical therapy. If you're worried about end of life expenses, there's also a Pet Owner assistance rider which can help cover the costs of cremation or burial.

Trupanion offers one of the most impressive reimbursement policies of any pet insurance company at 90%, well above the standard 70%. There monthly premiums are also highly competitive, so if affordability and value for money is high on your list, they're well worth looking into.

The drawbacks for this company are the longer waiting periods, 30 days for illnesses, and there's also no option to include coverage for things like vaccinations or microchipping. What we do love however is the direct payment system Trupanion has with with many of its providers, and 24/7 their customer service line is also impressive.

Overall, this is great company when it comes to value for money, just be sure that their policy has everything you're looking for before you purchase and if you're wanting more comprehensive coverage, you may wish to look elsewhere.

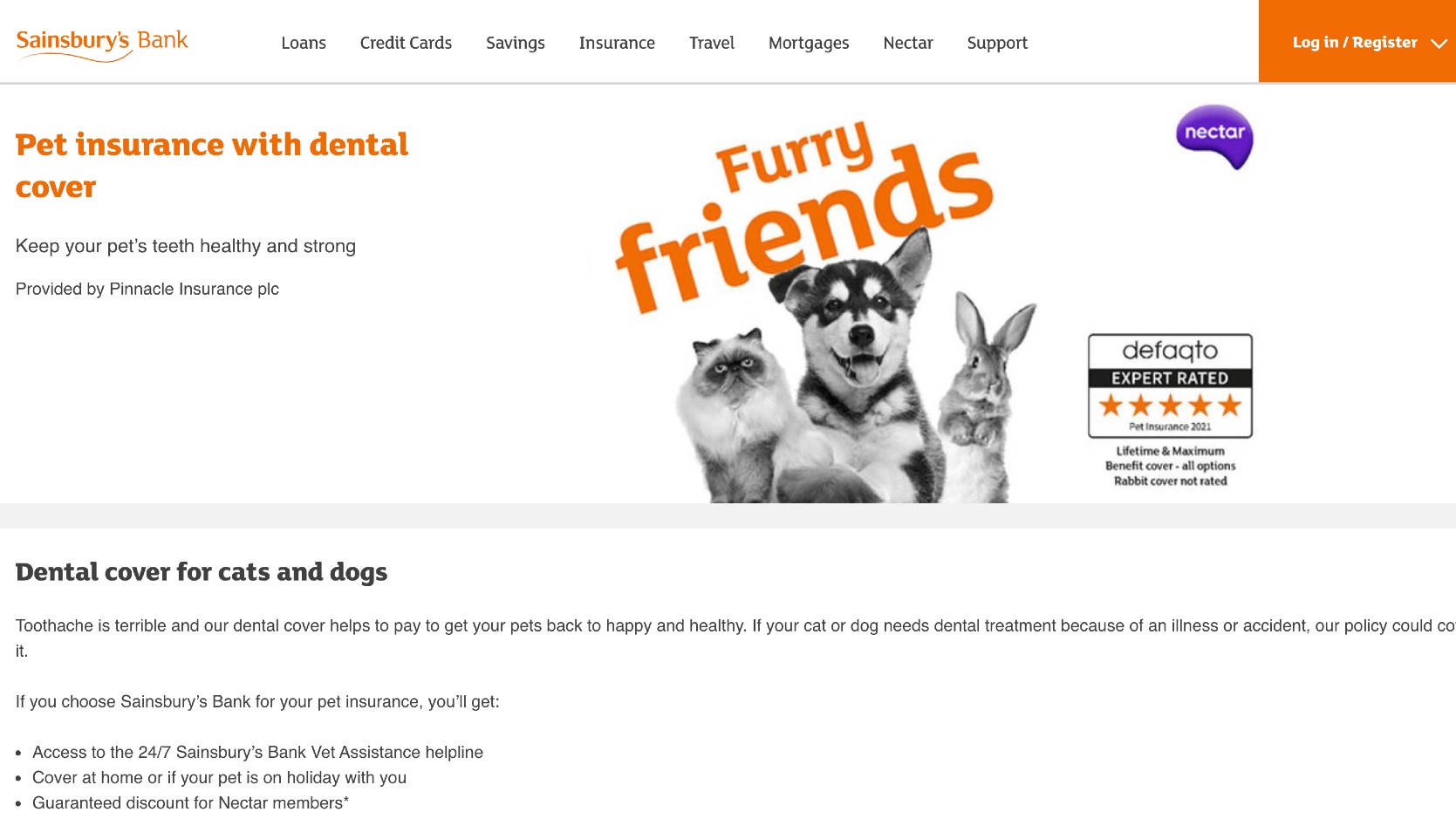

Sainsbury's

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

Sainsbury's may not primarily be known for its pet insurance, but the level and quality of its coverage really shouldn't be underestimated.

It offers a range of lifetime cover policies, with annual vet fee cover ranging from £2,500 to £10,000 a year. The most impressive inclusion in this is its level of dental cover, with its policies again covering anything up to £10,000 in a lot of cases.

Death cover is also included, with the policy putting up to £200 towards the cost of cremation, should this be the route to go down.

There are a lot of options, aided by the impressively user-friendly website, so there's a lot going for it in this regard.

There are probably cheaper policies around, and the restrictions on new policies for pets of a certain age (for some dog breeds, the age is put as low as five) seem harshly punitive.

Even so, it's clear that Sainsbury's can be relied on to look after your pet, with the company claiming that 98% of all claims made between September 2019 and September 2020, to use this time as an example, were paid out. So as a quick solution when money isn't an issue, this could be one to go for.

Geico

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

You're probably familiar with Geico as it's one of the largest insurers in the country, but what you may not know is that they also offer pet insurance and it can work out really affordable if you're on a tight budget.

The first thing to know is that Geico offers some really great discounts that can lower the cost of your premiums, including spaying and neutering discounts, multi-pet discounts, and savings of up to 10% if you pay your premium annually instead of monthly.

Their single accident and illness plan is highly customizable and you can get coverage for exam fees, treatments, and medications as long as the illness isn't a pre-existing one. You can also supplement with a wellness rider, although this can be quite expensive and the savings are low.

Coverage is available in five tiers, starting from $5,000 and going up to $30,000 and wellness plans are available in three tiers - $250, $450, and $650. It's worth bearing in mind that if you don't use up the benefits of your chosen wellness plan within the 12-months of each year, they aren't carried over to the next calendar year so you end up losing them.

Geico also doesn't service their own policies, instead choosing to outsource the administration to Embrace Pet Insurance. Their website is basic too, so it can be difficult to find information. But, when it comes to discounts, this company is hard to beat, so if you're looking to keep your costs low, Geico is a solid choice.

Petplan

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

Founded in 2003, Petplan has quickly grown to be a popular choice amongst owners looking for accident and illness coverage for their fur babies. While they only offer one policy, people are drawn to the wide range of customizable options, including a choice of three deductibles, two annual limits, and three reimbursement levels.

There's no option riders with the policy but you'll likely find you don't need one with the accident and illness plan covering everything from exam fees and lab tests to dental and behavioral treatment and even medical boarding. What you won't find though is any option for preventive care and you'll need to pay for vaccinations and spaying/neutering.

Plans start from around $20/month for both dogs and cats, increasing depending on your annual limit choice - $5,000 up to $15,000 - and you'll need to wait 15 days for the policy to become effective after signing up.

It's worth noting that Petplan have a fairly strict claims policy, the most notable point being that your dog or cat must see a vet within 48 hours of their accident or from when they first started showing symptoms of illness.

Overall, Petplan offers a comprehensive policy that is likely to meet most of your needs and their website is fantastic, with lots of great information and resources.

Figo

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

When it comes to awarding a company for their live chat and video support, Figo wins the gold medal in customer service with ease. This is one seriously tech-savvy company who's all about making your life easier.

Figo has an app that gives you 24/7 access to a live vet in case of an emergency and even better? The service is included in your policy so you don't need to worry about paying extra. Their customer service is exceptional across the board with options to connect via phone, text, live chat, email and even Twitter!

Now, in terms of plans, Figo has three and there's an option to add on wellness benefits. All of their plans are customizable and you can choose your reimbursement and deductible levels. Annual limits start at $5,000 and go up to unlimited, so there's great flexibility there to suit your budget.

Included in the main policies are things like procedures, medications, and lab tests but you'll need a rider to cover you for exam fees and things like vaccinations and dental treatment. Base monthly plans start at around $23 for dogs and $12 for cats.

If you're after the peace of mind that you'll always have access to a vet and want excellent customer service with plenty of contact options, Figo leaves most of the competition in the dust. Plus, their plans are pretty great too!

Specifications

Reasons to buy

Reasons to avoid

One name that comes up time and time again when speaking to pet owners about top insurance is Bought By Many.

The ‘complete’ option is described as the UK’s most comprehensive pet cover – so it’s safe to say you won’t get much more from an insurance policy elsewhere.

An annual vet fee limit of £15,000 should suit almost any breed, and as a ‘lifetime’ policy, you’ll also be covered for any condition that occurs after you take out the policy, so long as you renew annually. The good news is that Bought By Many also covers pre-existing conditions that have ended more than two years ago, while you can also quote for more recent conditions (so long as the treatment ended more than three months ago).

Access to a 24/7 video vet, included in the cost of your policy, adds peace of mind should you want a second opinion, and can avoid pricey trips to the actual vet for minor problems that can be easily solved.

The downside of such a comprehensive policy is the price. This is not a cheap monthly cost, so owners of young and otherwise healthy dogs will almost certainly be able to find cheaper options elsewhere. However, other owners tell us that the policy price tends to stay roughly the same throughout the lifetime of the animal, whereas other policies may be cheap at first, but may increase dramatically once you’ve needed to make a claim.

PetPlan

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

Another popular name in the pet insurance industry is PetPlan, who have been recommended to us by multiple pet owners. They’ve also won several awards over the years, so you can feel secure in the knowledge that you should be getting good service from this company.

PetPlan is a great option for lots of different types of pet owners, but particularly if you’ve got more than one animal, as you’ll get a multi-pet discount.

According to PetPlan, 98% of claims are paid out, and it even has the backing of the “SuperVet”, Noel Fitzpatrick. PetPlan offers “Covered For Life” policies, which means that should your pet require treatment for ongoing problems, they’ll be covered so long as your cover is continuous. That can be really important if they develop an expensive problem.

You can choose the level of cover you get here, and that will determine the price you pay. If you can afford it, it’s always worth going for the highest level of cover you can – vet bills can quickly mount up.

As another comprehensive policy, it’s not particularly cheap. However, you do need to consider the value that a comprehensive policy brings with it, should the worst happen and you need repeated expensive trips to the vets. You can check out our full review of Pet Plan here.

Waggel

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

One of the newest pet insurance companies on the market, Waggel promises to be as transparent as possible to make pet insurance simple.

Getting a quote is easy, and you can adjust the amount of cover you require in order to get the best value quote. If you’ve got a young or healthy dog, you might want to consider a relatively low amount of cover (say £2000), and benefit from cheaper premiums. If you can afford to pay a little more, you can choose a higher level of coverage – we’d always advise you to get the highest level of cover you can.

Waggel has a smartphone app with a 'dashboard' for following any claims you’ve made. You’ll be able to track the progress of your claim so you know exactly when a payment is made.

If you don’t need to make a claim – which hopefully you won’t – you can still take advantage of plenty of member benefits, including money off food, free behavioral consultations and access to a 24/7 video vet (one of only a handful of companies in the UK to offer such a service).

Finally, a nice touch is that Waggel supports charities, donating on your behalf from unclaimed premiums.

- Get the best equine insurance: Protect the biggest friend in your life

- Seven reasons to get your pet insured with the best policy possible – a vet’s view

- Pet insurance advice: Five things to look out for when shopping for the best policy

Animal Friends

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

Animal Friends is another insurer that has been mentioned several times by dog owners. It’s a well-liked company that trades off its ethical stance, annually donating money to charity. It has more than 20 years of experience and has won multiple awards.

Like some of the others mentioned in this round-up, you get access to a free video vet, which can save you an expensive trip to a standard vet (especially out of hours) and help give you peace of mind.

Unlike most policies, Animal Friends give you the option to cover your pet on a “per condition” basis. You can choose up to £6000 cover per condition, with no limit on how many different conditions you can claim for per year – if your pet develops a number of different problems throughout the year, this can be seriously helpful. The limit resets annually, so long as the cover is kept active. Your vet is also able to claim online on your behalf, which can save time and stress.

Animal Friends does not cover any pre-existing conditions, so if you’ve previously claimed that is something to be aware of. Some also tell us that once you’ve claimed, or the pet reaches a certain age, Animal Friends policies tend to get very expensive – but that is common among many insurers.

Tesco Pet Insurance Premier

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

A household name, not everyone is aware that Tesco also provides a wide range of financial services. Several pet-lovers we spoke to insure their pets with Tesco and have had good experiences when it comes to claiming and renewal prices.

This is another policy that comes complete with access to a 24/7 vet helpline who can give you advice on whether you need to visit an actual vet or not. This can be particularly helpful out of hours when vets charge a premium (and consultation fees won’t be covered by your premium).

Up to £10,000 worth of cover is available, which renews each year that the policy is active. There are different types of cover available, including the popular ‘Lifetime’ which is more expensive, but we’d recommend it as it protects you against recurring illnesses. If you’re on a tight budget, you can also look at “Extra”, “Standard” and “Accident & Injury” cover.

Dental cover is included, but pre-existing conditions won’t be covered. It’s also worth noting that Tesco requires you to use vets in its preferred referral network – if you use anyone outside of it, you will be liable for the first £200 of the vet bill yourself, in addition to your policy excess.

petGuard

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

With over 37 years of experience protecting cats and dogs, petGuard offers pet insurance that you can trust. Claims are easy and straightforward, with bills paid straight to your vet and interest-free monthly payments help make cover accessible and affordable.

While petGuard doesn’t cover pre-existing medical conditions, new long-term and chronic conditions are covered and you can also claim financial help with additional related costs, such as complementary treatments and emergency boarding.

We love that petGuard offers a multi-pet discount, covering multiple pets on one policy to save you time and money. And speaking of discounts, they have a special one just for PetsRadar readers with 20% off the cost of an annual policy. You’ll also get access to FirstVet, a 24/7 online service that lets you seek free expert advice and support when you need it.

Whether you have a kitten or cat, a puppy or dog, petGuard prides itself on delivering a personal service to every pet parent and their furkid. With great customer service and affordable policy options, this pet insurance brand is well worth considering.

More Than Pet Insurance

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

MoreThan is a trusted name in the insurance sector, and the same can be said for its pet insurance policies. You get up to £12,000 worth of cover with its 'Premier' option (also known as Lifetime).

If your budget is more restricted, you could also consider either reducing the amount of cover you have (a £4000 option is available) or go for one of the even cheaper options such as 'Classic' and 'Accident Only' – just make sure you’re aware of the limitations and exclusions that the policy provides.

Like some other providers, you have access to a 24/7 phone line to answer queries and concerns about your pet without necessarily having to visit your vet in person. Like Tesco, MoreThan requires you to use a vet within the preferred referral network, or be liable for the first £200 of the vet bill. Most people will find a vet in the network relatively close by, but it’s something to consider.

If you have an older dog, the price of the policy will increase, and you will also find that the excess (the amount of the claim you’re required to contribute yourself) will also increase.

Those who already have existing policies with MoreThan (such as Home or Car insurance) can claim a discount, while new customers also get 25% off.

Direct Line

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

Direct Line offers affordable pet insurance across both its Essential Cover and Advanced Cover plans with prices ranging from £6.50 to £10.50 per month. Plus, as a bonus, you get a great discount when you purchase your plan online which gives you 3 months of your first year’s coverage free.

The Essential Cover plan enables you to claim up to £4,000 in vet fees, as well as providing cover for diseases, accidents, and injuries, but there is a 12-month time limit per condition. The Advanced Cover plan gives you all the perks of the Essential but with dental disease coverage and no time limit for medical conditions. Pre-existing medical conditions are not covered under either policy.

With Direct Line you’ll also get free access to PawSquad, a 24/7 live chat and video service that connects you with UK vets who can see your pet and offer help and advice. Their partnership with Pet Drugs Online means you can also save on the cost of prescriptions, medications, and access discounted pet food, toys, and general health products.

Agria

Our expert review:

Specifications

Reasons to buy

Reasons to avoid

Agria has been a highly-rated pet insurance company for some time, picking up prestigious awards and gaining itself a great Trustpilot rating. It has a wealth of experience in the market, having been founded in Sweden in 1890. It began operating in the UK in 2009 where it specializes in lifetime pet insurance. The company has, however, yet to make it to the US.

Covering dogs, cats and rabbits, Agria has a particularly attractive policy called Lifetime Plus which we would recommend that you consider. It gives you a vet fee limit of £12,500 each year which should be plenty (that's £6,000 more than its standard Lifetime policy). It also offers £3 million of third party liability (a million more than standard).

The vet fee limit includes accident and illness dental cover but you won't get cover for routine check-ups. Neither are you going to be covered for routine pet care which is to be expected, although you will get a £25 voucher towards annual checks and vaccinations with the higher level policy. You also get a £50 pet healthcare voucher to spend at your practice with every new cat and dog policy. That's a nice touch in our book.

In terms of claims, Agria says it pays out 97 percent of the time, with processing taking up to five to eight working days. But how easy is it to get a quote? Well, the form isn't as attractive as some other companies but it does the job well, using the minimum of screens. You also get an instant quote with an option to choose your excesses and any extras such as overseas travel, death and loss and boarding fees.

The form also asks if you have a promotional code, so maybe take a look online to see if you can find one. Otherwise it's just a matter of checking the policy and paying. It’s a shame that there’s no online assistance should you get stuck but there is a phone number and it is prominently displayed so you can discuss matters the traditional way. Customer service is only open during working hours, though, so no Sundays, between 9am and 6pm weekdays and 9am and 1pm on Saturdays.

How to choose the best pet insurance

Pet insurance is not a legal requirement, but it’s highly recommended since vet bills can easily rack up to the thousands if the worst happens.

Choosing the right policy can be overwhelming though, as you’ll want to make sure you’ve got the best possible cover for your pet.

We would always recommend that you do as much research as possible and check the small print of any policy you’re considering buying.

‘Lifetime’ cover is always worth considering since any illnesses or conditions that develop with your pet will be covered (so long as you renew the policy). It can be more expensive on a monthly basis, but it could save you a small fortune if you need it down the line.

Existing conditions can be covered by some insurers, but it’s rare. Some will cover pre-existing conditions so long as the treatment ended some time ago. If your pet has been treated before, think seriously before switching insurance companies and always double-check with any new insurer if anything is excluded.

You should always check to see if dental cover is included too. Some include it as standard, while others exclude it. Those that do include it may have a limit on the amount they will pay out.

It’s also worth looking out for those that offer a phone line for advice, or better yet, a video service. Small concerns that can be addressed over the phone can save you a pricey midnight trip to the vet, for example.

Finally, have a look at how much ‘liability’ cover you get. That is, how much your insurer will pay out if your dog damages somebody else’s property or injures another animal or person.

If your pet is suffering from a long-term issue and you're struggling to find a policy that will cover it, take a look at our guide to the best pet insurance for pre-existing conditions for some suggestions.

Get the best advice, tips and top tech for your beloved Pets

Amy Davies is a freelance writer and photographer with over 15 years experience. She has a degree in journalism from Cardiff University and has written about a huge variety of topics over the years. These days she mostly specialises in technology and pets, writing across a number of different titles including TechRadar, Stuff, Expert Reviews, T3, Digital Camera World, and of course PetsRadar. She lives in Cardiff with her dog, Lola, a rescue miniature dachshund.